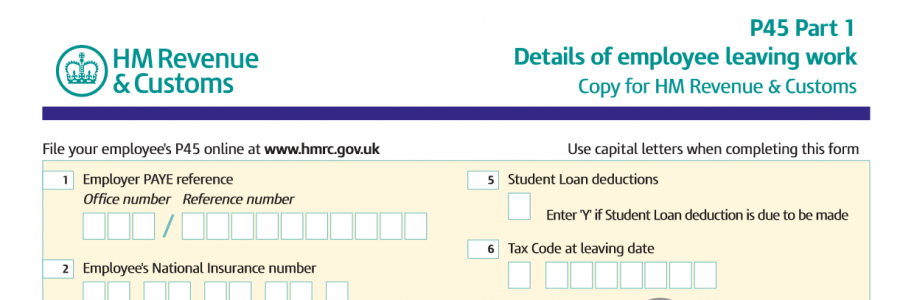

I’ve left my job, what should I do with my pension?

Well, the simple answer is, you can leave it where it is, or you can move it! Depending on what type of pension it is, […]

Continue reading »Demystifying Pensions

Well, the simple answer is, you can leave it where it is, or you can move it! Depending on what type of pension it is, […]

Continue reading »

If you have a personal pension, stakeholder pension or SIPP, you might be wondering about how and when you can withdraw money from it. Well, […]

Continue reading »

There are several different pension types available and the terminology can be confusing. Here we explain the main differences between types of pension. Defined Benefit […]

Continue reading »

Your company may offer Salary Sacrifice as a way of contributing to your pension scheme. Read more about the pros and cons and decide whether […]

Continue reading »

If you’ve been, or are about to be, automatically enrolled in your companies pension scheme, you may be worried about where that money goes, and […]

Continue reading »

Auto enrolment has now been rolled out to most companies in the UK (and should be completed by February 2018). If you work in the […]

Continue reading »

One of the disadvantages of these types of investment fund are that, if the stock market crashes and lots more people sell their units in […]

Continue reading »

Most people have pensions that have been set up through their work or by a financial adviser, and automatically invest your money in one or […]

Continue reading »

Your money won’t be looked after for free, and pension charges are inevitable. The amount you are being charged can very wildly from provider to […]

Continue reading »

Unlike most stocks and shares which can be bought at any time when the markets are open, a unit trust is only generally traded once […]

Continue reading »